2815-2010 Agreement with AMO (Federal Gas Tax)

BEING A BY-LAW TO ENTER INTO AN AGREEMENT WITH THE ASSOCIATION OF MUNICIPALITIES OF ONTARIO

Passed by Council March 8, 2010

CORPORATION OF THE TOWNSHIP OF AUGUSTA

BY-LAW NUMBER 2815

A BY-LAW TO ENTER INTO AN AGREEMENT WITH

THE ASSOCIAITON OF MUNICIPALITIES OF ONTARIO

WHEREAS the Municipal Act, 2001 c. 25 S.O. 2001 section 8 allows for the Powers of

a Natural Person and those powers may include the entering into an agreement.

NOW THEREFORE the Council of the Township of Augusta hereby enacts as follows:

1. That the terms of the agreement are hereby referred to as Schedule “A” to By-

Law 2815.

2. The Reeve and the CAO are hereby authorized to sign the agreement on behalf

of the Corporation of the Township of Augusta.

READ a first and second time this 8th day of March, 2010.

READ a third time and passed this 8th day of March, 2010.

Signed by Reeve Mel Campbell and Clerk Linda Robinson

THIS AMENDING AGREEMENT made in duplicate this 8th day of March, 2010.

BETWEEN:

THE ASSOCIATION OF MUNICIPALITIES OF ONTARIO

(referred to herein as “AMO”)

-and-

THE CORPORATION OF THE TOWNSHIP OF AUGUSTA

(referred to herein as the “Recipient”)

WHEREAS Canada, Ontario and Ontario municipalities, as represented by AMO and

Toronto entered into an Agreement for the Transfer of Federal Gas Tax Revenues Under the

New Deal for Cities and Communities on June 17, 2005 (amended on June 20, 2007) (the

“Canada-Ontario-AMO-Toronto Agreement”), whereby AMO agreed to administer funds on

behalf of Ontario municipalities made available pursuant to the Canada-Ontario-AMO

Toronto Agreement on behalf of Canada;

WHEREAS the Canada-Ontario-AMO-Toronto Agreement outlines a framework for the

transfer of funds to Ontario municipalities, represented by AMO and Toronto with stable,

reliable and predictable funding for environmentally sustainable infrastructure purposes;

WHEREAS Canada, Ontario and Ontario municipalities, represented by AMO and

Toronto have amended the Canada-Ontario-AMO-Toronto Agreement on September 3,

2008, in order to confirm municipalities’ Gas Tax Fund allocations to 2014;

AND WHEREAS AMO and the Recipient have previously entered into a Municipal

Funding Agreement for the Transfer of Federal Gas Tax Revenues Under the New Deal for

Cities and Communities;

NOW THEREFORE this Amending Agreement witnesseth that:

1. The preamble forms an integral part of this Amending Agreement.

2. Terms not defined in this Amending Agreement have the meanings assigned in the

Municipal Funding Agreement For the Transfer of Federal Gas Tax Revenues

Under The New Deal for Cities and Communities.

a. Audit Statement definition is deleted and replaced as follows:

“Audit Statement” means a written audit statement to be prepared and

delivered to AMO as set out in section 7.1h hereto.

b. End of Funds definition is deleted and replaced as follows:

“End of Funds” means March 31, 2014.

c. Infrastructure Program definition is deleted and replaced as follows:

“Infrastructure Program” means Canada’s infrastructure programs in

existence at the time of the execution of this Agreement.

d. Large Municipalities definition is deleted and replaced as follows:

“Large Municipalities” means those Municipalities with a 2006 National

Census data population of 500,000 or more including the Regional

Municipalities of Durham, Peel and York and the Cities of Hamilton,

Mississauga and Ottawa.

e. Treasurer definition is added:

“Treasurer” means a municipal treasurer as defined in subsection 286(1) of the

Municipal Act, 2001 (Ontario).

f. Treasurer’s Certificate definition is added:

“Treasurer’s Certificate” means a written statement by the Treasurer to be

prepared and delivered to AMO as set out in section 7.li hereto and in the form

identified in Schedule H attached.

3. Section 2.1 is deleted and replaced as follows:

2.1. Term. Subject to any extension or termination of this Agreement or the

survival of any of the provisions of this Agreement pursuant to the provisions

contained herein, this Agreement shall be in effect from the date set out on the first

page of this Agreement, up to and including March 31, 2015.

4. Section 3.lc is deleted and replaced as follows:

c. ensure that there is no reduction in capital funding provided by Municipalities for

Municipal Infrastructure.

5. Section 3.ld is deleted and replaced as follows:

d. In the case of Recipients that are Municipalities in excess of 100,000 in

population, ensure that over the period of January 1, 2010 to March 31, 2014 the

Recipient’s capital spending on Municipal Infrastructure shall not fall below its Base

Amount; and,

6. Section 3.1e is added:

e. ensure any of its contracts for the supply of services or materials to implement

its responsibilities under this Agreement shall be awarded in a way that is

transparent, competitive, consistent with value for money principles and pursuant

to its adopted procurement policy.

7. Section 4.2 is deleted and replaced as follows:

4.2. Exception. For Large Municipalities, the list of eligible categories shall

consist of no more than two (2) of the categories in Section 4.1 a. to f.

8. Section 5.4 is deleted and replaced as follows:

5.4 Retention of Receipts. The Recipient shall retain all evidence (such as

invoices, receipts, etc.) of payments related to Eligible Costs and such supporting

documentation must be available to Canada when requested and maintained by

the Recipient for audit purposes in accordance with the municipal records retention

by-law.

9. Section 6.7 is deleted and replaced as follows:

6.7. Expenditure of Funds. The Recipient shall expend all Funds by

December31, 2016.

10. Section 6.8 is deleted and replaced as follows:

6.8. GST and HST. The use of Funds is based on the net amount of goods

and services tax or harmonized sales tax to be paid by the Recipient pursuant to

the Excise Tax Act (Canada) net of any applicable rebates.

11. Section 7.1 h is deleted and replaced as follows:

h. an annual Audit Statement, if Funds were applied to Eligible Costs incurred for

Eligible Projects in respect of the previous Municipal Fiscal Year. An annual Audit

Statement is to be prepared by the Recipient’s auditor in accordance with section

5815 of the Canadian Institute of Chartered Accountants Handbook — Special

Reports — Audit Reports on Compliance With Agreements, Statutes and

Regulations, providing assurance that the terms of the Agreement have been

adhered to and Funds received by the Recipient have been spent in accordance

with the Agreement;

12. Section 7.li is added:

i. a Treasurer’s Certificate, if Funds were not applied to Eligible Costs incurred for

Eligible Projects in respect of the previous Municipal Fiscal Year. A Treasurer’s

Certificate is to be prepared by the Recipient’s Treasurer, providing assurance that

activity related to sections 6.4, 6.5, and 11 has been conducted within the terms

and conditions of the Agreement.

13. Section 7.2 is deleted and replaced as follows:

7.2. Outcomes Report. The Recipient shall account in writing for outcomes

achieved as a result of the Funds through an Outcomes Report to be submitted to

AMO upon completion of an Eligible Project and to be made available publicly in

manner consistent with financial reporting under the Municipal Act, 2001 5.0. 2001

c.25 by March 31st of the following Municipal Fiscal Year.

a. The Recipient’s Outcomes Report shall report in

investments made, in a manner to be provided by

on the degree to which these investments have

objectives of cleaner air, cleaner water and reduced

writing on the cumulative AMO, including information

actually contributed to the greenhouse gas emissions.

14. Section 9.2 is deleted and replaced as follows:

9.2. Separate Records. The Recipient shall maintain separate records and

documentation for the Funds and keep all records including invoices, statements,

receipts and vouchers in respect of Eligible Projects that Funds are paid in respect

of in accordance with the municipal records retention by-law. Upon reasonable

notice, the Recipient shall submit all records and documentation relating to the

Funds to Canada for inspection or audit.

15. Notwithstanding the date of execution of this Amendment Agreement, the

provisions of this Amending Agreement are in effect as of January 1, 2010 and

continue in effect for the duration of the term of the Municipal Funding Agreement

For the Transfer of Federal Gas Tax Revenues Under The New Deal for Cities and

Communities.

16. Section 14.3 is deleted and replaced as follows:

14.3. Addresses for Notice. Further to Section 14.1 of this Agreement,

notice can be given at the following addresses:

a. If to AMO:

Executive Director

Federal Gas Tax Agreement

Association of Municipalities of Ontario

200 University Avenue, Suite 801

Toronto, ON M5H 3C6

Telephone: 416-971-9856

Facsimile: 416-971-6191

Email: gastaxamo.on.ca

b. If to the Recipient:

Richard Bennett

CAO/Clerk

Township of Augusta

R.R.#2

Prescott, ON KOE1TO

Telephone: (613) 925-4231

Facsimile: (613) 925-3499

Email: rbennett@augusta.ca

17. Section 15.4 is deleted and replaced with the following:

15.4 Survival. The following schedules, sections and provisions of this

agreement shall survive the expiration or early termination hereof: Sections 5, 6.7,

7, 9.3, 10.4, 10.5, 11, 12.3, 15.7, and Schedule G.

18. Section 16.1, Schedule A is amended as attached.

19. Section 161, Schedule H is added as attached.

20. Except as amended herein, the provisions of the Municipal Funding Agreement For

the Transfer of Federal Gas Tax Revenues Under The New Deal for Cities and

Communities remain in full force and effect.

IN WITNESS WHEREOF this Agreement has been executed by the duly authorized officers

of the parties hereto as of the date first above written.

RECIPIENT’S NAME: THE CORPORATION OF THE TOWNSHIP OF AUGUSTA

By:

Signed by Reeve Mel Campbell on March 10, 2010 & CAO Richard Bennett on March 10, 2010

THE ASSOCIATION OF MUNICIPALITIES OF ONTARIO

By:

Signed by the Executive Director on March 31, 2010 and the Director of Administration and Business Development on March 31, 2010

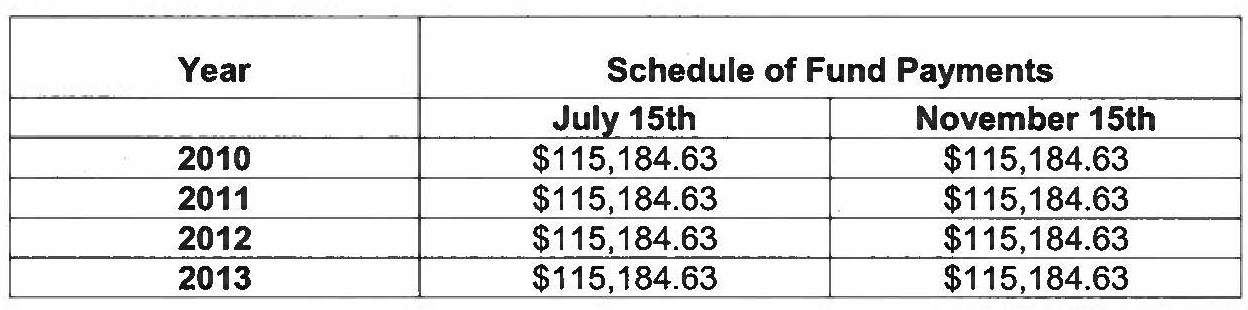

SCHEDULE A

SCHEDULE OF FUND PAYMENTS

RECIPIENT’S NAME: The Corporation of the Township of Augusta

The following represents the minimum Funds and schedule of payments over the life of

this Amending Agreement.

SCHEDULE H

TREASURER’S CERTIFICATE

To the Association of Municipalities of Ontario

As the Treasurer of the Corporation of <INSERT MUNICIPAL NAME>, I acknowledge

that for the 20_ Municipal Fiscal Year, there were no Eligible Costs incurred for Eligible

Projects under the Agreement.

I confirm that the Corporation of <INSERT MUNICIPAL NAME> received its Federal

Gas Tax allocation for the 20 Municipal Fiscal Year within the terms and conditions

specified in section 6.4 of the Agreement.

I also confirm that the carry-over of unexpended Funds followed the terms and

conditions of section 6.5 of the Agreement Specifically, the interest earned on unspent

funds has been calculated on a reasonable basis, the interest was calculated on a

similar basis as other reserve and reserve funds, and that the interest rate used is

comparable to the one used for other reserve funds which are required to earn interest.

I also confirm that the title to Municipal Infrastructure resulting from Eligible Projects is

retained by the Corporation of <INSERT MUNICIPAL NAME> as specified under

section 11.1 of the Agreement

As the duly appointed Treasurer of the Corporation of <INSERT MUNICIPAL NAME> I

hereby certify that, as at December31, 20, activity related to the Municipal Funding

Agreement for the Transfer of Federal Gas Tax Revenues Under the New Deal for

Cities and Communities dated <INSERT DATE ON MFA> between the Association of

Municipalities of Ontario and the <INSERT MUNICIPAL NAME>, has been conducted

within the terms and conditions set out in the Agreement.