3517-2021 Tax Rates for 2021

BEING A BY-LAW TO ADOPT THE YEARLY ESTIMATES AND TAX RATES AND TO FURTHER PROVIDE FOR PENALTY AND INTEREST IN DEFAULT OF PAYMENT

Passed by Council April 12, 2021

REPEALED April 25, 2022 by By-Law 3563-2022

THE CORPORATION OF THE TOWNSHIP OF AUGUSTA

BY-LAW NUMBER 3517-2021

A BY-LAW TO ADOPT THE YEARLY ESTIMATES AND TAX RATES AND TO

FURTHER PROVIDE FOR PENALTY AND INTEREST IN DEFAULT OF PAYMENT

WHEREAS Section 290(1) of the Municipal Act 2001 c. 25 states that a local municipality

shall in each year prepare and adopt a budget including estimates of all sums required

during the year provides that Municipal Councils shall adopt an estimated levy for the

current year and pass a By-Law to levy a separate tax rate on the assessment in each

property class:

AND WHEREAS Sections of the said Act require tax rates to be established in the same

proportion to tax ratios.

AND WHEREAS certain regulations require reductions in certain tax rates for certain

classes or subclasses of property;

NOW THEREFORE THE COUNCIL OF THE CORPORATION OF THE TOWNSHIP OF

AUGUSTA ENACTS AS FOLLOWS:

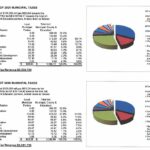

1. The Council hereby adopts a tax levy of $5,230,730.00 for all purposes for 2021.

2. That a tax rate of 0.00623639 is hereby adopted to be applied against the whole

of the assessment for real property in the residential/farm class.

3. That a tax rate of 0.00623639 is hereby adopted to be applied against the whole

of the assessment for real property in the multi-residential class.

4. That a tax rate of 0.00839667 is hereby adopted to be applied against the whole

of the assessment for real property in the commercial occupied class.

5. That a tax rate of 0.00587767 is hereby adopted to be applied against the whole

of the assessment for real property in the commercial vacant units and

commercial vacant land classes.

6. That a tax rate of 0.01129659 is hereby adopted to be applied against the whole

of the assessment for real property in the industrial occupied class.

7. That a tax rate of 0.00734279 is hereby adopted to be applied against the whole

of the assessment for real property in the industrial vacant units and industrial

vacant land classes.

8. That a tax rate of 0.01748372 is hereby adopted to be applied against the whole

of the assessment for real property in the large industrial occupied class.

9. That a tax rate of 0.01136442 is hereby adopted to be applied against the whole

of the assessment for real property in the large industrial vacant lands class.

10. That a tax rate of 0.01032185 is hereby adopted to be applied against the whole

of the assessment for real property in the pipeline class.

11. That a tax rate of 0.00155910 is hereby adopted to be applied against the whole

of the assessment for real property in the farmland and managed forests classes.

12. That every owner of land shall be taxed according to the tax rates in this By-Law

and such tax shall become due and payable on the 30th day of September 2021.

13. On all taxes in default on the 1st day of October, a penalty of 1.25% shall be added

and thereafter a penalty of 1.25% per month will be added on the 1st day of each

month the default continues, until December 31st, 2021. The date payment is

received at the Township office will be taken as the date paid on taxes paid by

mail. The date received in the Township’s bank account will be taken as the date

paid on taxes paid at a banking institution, by telephone banking or Internet

banking. The Manager of Finance/Treasurer nor designate has no authority to

waive any penalty.

14. On all taxes in default on January 1st, 2021, interest shall be added at the rate of

1.25% per month on the first day of each month the default continues.

15. Penalties and interest added in default, shall become due and payable, and shall

be collected as if the same had originally been imposed and form part of such

unpaid tax levy.

16. The Treasurer, not later than 21 days prior to the date that the installment is due,

shall mail or cause to be mailed to the address of the residence or place of

business of each person a notice setting out the tax payment or payments required

to be made pursuant to this by-law, the date by which they are to be paid to avoid

penalty and the particulars of the penalties imposed by this by-law for late

payments.

17. Where arrears of taxes exist, any payment toward taxes received shall first be

applied against penalty and interest and then arrears until fully paid, before being

applied to current taxes.

18. It shall be the duty of the Treasurer immediately after the date named in Section

19 to collect by distress or otherwise under the Provisions of the Statutes in that

behalf all such tax installments or parts thereof as shall not have been paid on or

before the respective dates provided aforesaid together with the said percentage

charges as they are incurred.

19. Taxes shall be payable to the Township of Augusta and shall be paid to the

Treasurer at the Township Office, 3560 County Road 26, Prescott, Ontario, by mail

or in person. Taxes may also be paid through a financial institution, to the credit

of the Treasurer of the Township, either directly, by telephone or internet.

20. That the sum of yearly expenditure estimates to be adopted by the Council of the

Corporation of the Township of Augusta for the 2021 Budget Year are detailed in

Schedule 1 to this By-Law.

21. That as per the suggestion of the Auditor that all surplus funds from the year 2020

be transferred into general reserves for the 2021 year.

22. By-law 3468-2020 is hereby repealed.

Read a first time and second time this 12th day of April 2021.

Read a third time and passed this 12th day of April 2021.

Signed by Mayor Doug Malanka and Clerk Annette Simonian

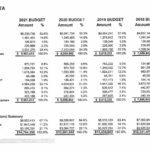

SCHEDULE I

TO BY-LAW NUMBER 3517-2021

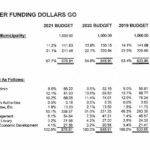

The sum of yearly expenditure estimates to be adopted by the Council of the

Corporation of the Township of Augusta for the 2021 Budget Year are $9953413

and are broken down as follows:

a) General Government

Council $ 106,929

Administration $ 866,202

b) Protection to Persons and Property

Fire $ 1,204,734

CEMP $ 20,094

Policing $ 1,015,364

Conservation Authority $ 46,496

Building Inspection $ 132,268

Bylaw Enforcement $ 41,696

c) Transportation Services

Roads $ 4,953,850

Street lighting $ 30,379

d) Environmental Services

Waste Management $ 806,415

e) Health Services

Cemeteries $ 6,000

f) Recreation and Cultural Services

Recreation Programs $ 189.891

Library $ 127,307

Donations $ 8,000

g) Planning

Planning $ 238,267

Economic Development $ 129,050

Agriculture & Drainage $ 29,871